Why choose a company car as a self-employed professional?

Looking for a company car as a self-employed professional? Whether you're a freelancer, consultant, or small business owner, having the right vehicle is essential for staying mobile, flexible, and professional. A company car offers more than just transportation. It’s a business tool that supports your daily operations, client meetings, and even personal errands. But traditional ownership comes with high acquisition and maintenance costs. SIXT business offers a smarter, more flexible solution: long-term rentals tailored to your needs.

Top 10 Benefits of a Company Car for the Self-Employed

- 1) Access to a wide range of premium vehicles

- 2) Always the right car for every job

- 3) Flexible rental periods

- 4) No upfront investment

- 5) Ready for international projects

- 6) No running costs during slow business periods

- 7) No seasonal price fluctuations

- 8) Easy accounting and billing

- 9) Private use included

- 10) Drive the latest models

Car rental for company cars: Flexible alternative to buying and leasing

Buying or leasing a car can tie up capital and create long-term liabilities. SIXT business provides more flexible solutions such as long-term rental and car subscription. You will find the ideal overall package and delivers distinct advantages to the self-employed. Especially the immediate availability, flexible rental times, and the non-existent residual value loss grant our company rental option with an unbeatable value. Profit from an overall cost reduction, optimized processes, and an excellent price-performance ratio.

| Company car rental | Leasing | Car purchase | |

|---|---|---|---|

Fixed price | ✔ | ✔ | possible |

Immediate availability | ✔ | X | possible |

Flexible contract terms | ✔ | X | X |

Registration & taxes included | ✔ | additional | additional |

Insurance package | ✔ | additional | additional |

Maintenance & wear | ✔ | additional | additional |

Seasonal tires | ✔ | additional | additional |

Transfer cost | ✔ | additional | additional |

Liability insurance | ✔ | additional | additional |

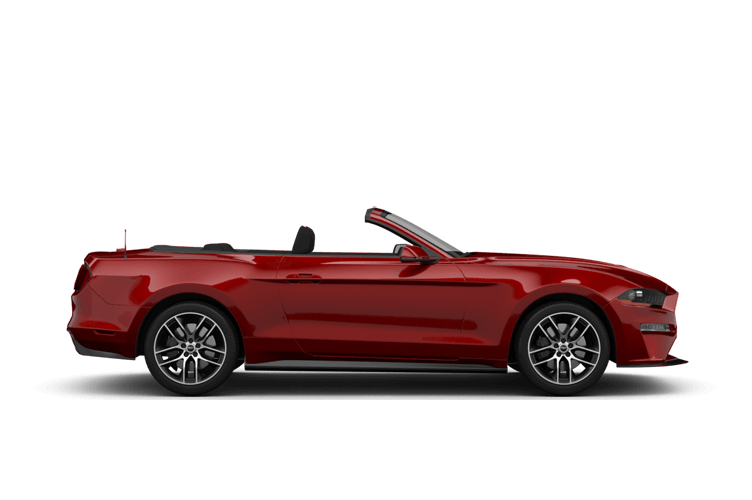

Company car models for the self-employed

Please note that with SIXT, you always book a vehicle class, ensuring availability of an equivalent model.

Benfits of a company car for self-employed

As a self-employed professional, having a company car brings a wide range of benefits startwing with mobility and flexibility. But buying or leasing a vehicle often means high upfront costs, long-term commitments, and unpredictable expenses. That’s where SIXT business comes in: we eliminate the downsides of ownership and give you full access to a flexible, stress-free solution.

You enjoy access to a diverse fleet of the latest vehicle models: Whether you're meeting clients, delivering goods, or managing projects across borders, we have the right car for your needs. No need to invest in multiple vehicles or worry about depreciation. Our flexible rental terms help you stay financially agile. You avoid seasonal fluctuations, reduce risk, and simplify your accounting.

SIXT Business is the all-in-one solution for freelancers, small businesses, and startups. With immediate availability, no acquisition costs, and global reach, our company car rental service is the smart choice for the self-employed. Register in just a few steps and get the car you need today.

Guidance on company car taxes for the self-employed

The laws on company car taxation may vary in every state. If your company owns the car, the financial worth of your business driving is a tax-free fringe benefit supplied by your company. This only applies if the business owns the car.

Tax deductions for self-employed vehicles

When a business owns a company car, it can deduct all associated real expenses. These can include, but are not limited to: depreciation, car loan interest, and insurance charges. If your firm is a pass-through organization (e.g., a sole-proprietorship, a limited liability corporation, or an S-corporation, among others), these deductions can reduce the amount of taxable profit passed through to your tax return. Otherwise, these expenses cannot be deducted.

The use of the automobile for personal purposes is a taxed fringe benefit. That sum must be added to your annual salary and income, and taxes must be paid on it. Find out more about the taxation of corporate cars in our article: How to use small business tax deductions.

Standard mileage rate vs. actual expense

To calculate the deductable car expense for business-related trips, either the standard mileage rate or the actual expense method (fuel, insurance, repairs, etc.) can be applied. Find out more about these methods and how to calculate business mileage.

How to get a company car as self-employed

Getting a company car as a self-employed person is easier than ever with SIXT business:

- 1. Register as a business customer

- 2. Unlock your exclusive business discount

- 3. Book your car for short- or long-term use

- 4. Drive – for business and personal use

Your advantages with SIXT business

- Short-term rental

- Easy registration in just a few steps: Register - secure company discount - book

- Premium company car fleet - ideal for self-employed professionals

- No upfront costs or long-term commitments

- Always drive the latest models

- Full flexibility and global availability

That might be of interest to you.

Discover SIXT business! Find your perfect company car, rental car for your next business trip, or THE fleet solution for your company.

- Electric & hybrid company cars

- Mid-size company cars

- SUV company cars

- Compact company cars

- Premium company cars

- Company van rental